Not every new company starts off with perfect tax habits, but it is important that you learn from your mistakes and correct them as you go. It is always best to correct any IRS issues voluntarily rather than being forced. A company that does not comply with the IRS rules and regulation may be subjected to severe consequences. Learn the 5 most devastating mistakes that a company can make.

Not every new company starts off with perfect tax habits, but it is important that you learn from your mistakes and correct them as you go. It is always best to correct any IRS issues voluntarily rather than being forced. A company that does not comply with the IRS rules and regulation may be subjected to severe consequences. Learn the 5 most devastating mistakes that a company can make.

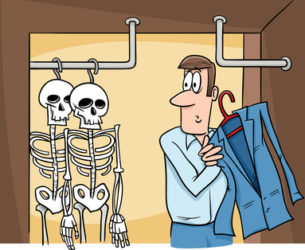

5 Tax Skeletons You Need to be Worried About.

- Not Filing Tax Returns: Did you know that the IRS will assess a tax liability to you if did not file? If you have not filed a return, the IRS will assess an exaggerated tax amount, charge you penalties for failure to file, plus interest on top of what you currently owe. The amount due from this IRS assessment is usually larger than the actual tax penalties and interest due compared to a taxpayer filed return.

- Stock Ownership Transaction: Buying and selling incorrectly or not completing proper documentation.

- Contingent Tax Liability: If you did not file your business taxes accordingly, you may face serious consequences from the tax authorities. In addition to facing the tax penalties and interest, the business’s stakeholders (investors, bankers, employees, vendors and tax authorities) may lose confidence in the business’s “Certainty as a Going Concern”, ultimately causing them to abandon the company because of the appearance that business may not be able to operate as an on-going business concern for the long term. Consequences of Your Business Lacking “Going Concern”:

- Banks may refuse to lend or may recall a bank loan.

- Investors may choose not to invest or they may ask for tough protective investing terms.

- Employees, vendors and tax authorities may decide to end their relationship with a business they deem as uncertain.

- Previous Owner Liabilities

If you are buying a business make sure the business is up to date with all the liabilities concerning the IRS or any other liabilities the business had engaged previous to the sale or purchase. Some of the liabilities could be:- Taxes

- Sales Taxes

- Payroll Taxes

- Lawsuits

- Liens and Debts

- “Misrepresentations”

If you become aware of any misrepresentations whether intentional or not, this is a BIG ISSUE in accounting taxes and financial representations. An intent to take advantage, mislead or unlawful behavior is relevant to take care of to avoid many complications related to misrepresentation. A misrepresentation can cause banker to reject a line of credit, an investor legal dispute, a tax issue or other costly and stressful problems.

The appearance of an accounting misrepresentation can be construed as:- Tax Fraud

- Tax Crimes

- Misrepresentation on Financial Statements

- Lack of credibility

If your company has possible tax issues it is always best to correct any errors before the tax authorities are aware. Skeletons in the closet don’t have to be that scary, what’s scary is the unknown of what consequence is. Please contact Rosillo & Associates P. A. if you suspect your business has any tax skeletons in the closet.